The second largest textile and ready wear exporter of global market, India plans to maintain its competitive advantage via shifting its conventional facilities. Steps in this road already started to pick positive results.

Among important manufacturing countries of global textile and ready-wear industry, India takes place with a long history in industry. As an attractive manufacturer with cheap production cost and high number while the country is facing a shift with investments in recent years. Industry should examine India as it is a market for Turkish textile machinery industry and a competitor and a supplier as well for Turkish textiles. “India Textile and Ready-Wear Industry Country Note” report, which was prepared by Turkey’s New Delhi Embassy Commerce Consultancy and was released by İTKİB, gives important clues for the interested ones.

Advantages: Long History, Rich Raw Material Source, Low Cost

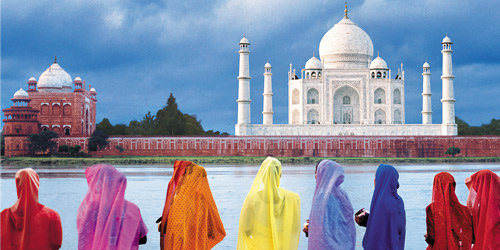

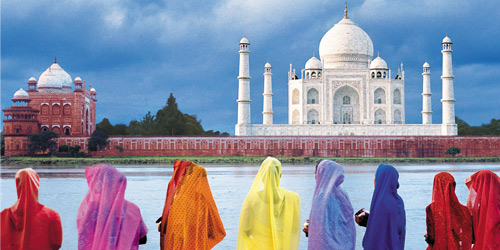

India has a very long past in textiles that goes back to B.C 3000s while the country’s first cotton factory was established in Bombay in 1854. In the following years, the number of cotton and textile plants rose rapidly. India is a very rich geography in terms of cotton, silk and jute fibers. Owning a variety of yarn types, India weaves those at hand weaving plants conventionally with intense effort and are dyed with organic dyes. The industry was idled under the tutelage of United Kingdom, while progress made itself felt once independence was obtained.

According to 2013 data, textiles contribute to GNP by 4% and exports by 13%. In the same period, 8% of tax incomes were obtained from textiles. The industry is foreseen to have a volume of around USD 108 billion which is expected to hit USD223 billion until 2021. Exports of textiles and ready-wear are also forecast to reach USD82 billion until 2012. The country’s total fabric production was 63.5 billion meter square in 2014, while it is expected to hit USD112 billion meter square until 2017.

The 2nd Largest Power of Global Market

India followed China as the second largest global exporter of textiles and ready-wear in 2013 with USD40 billion of exports. Plus, the country also ranks as the largest exporter which can export without depending on imports. Only in ready-wear field, India ranked as the 6th with exports at USD15.7 billion. The largest export arm is ready-wear, which is followed by synthetic and man-made filaments as well as synthetic and man-made inconstant fibers. In 2015, India’s textile and ready-wear imports stood at USD6 billion. Among imported products, synthetic and man-made filaments and fibers as well as textiles suitable for weaving had the largest share.

India consists of 24% of the global yarn spinning capacity. Owning 8% of the world’s spindle and global rotor capacity, India is the world’s largest weaving producer in term of capacity with a 63% share. Looking at its yarn and fiber power, India is the world’s largest jute producer, the second cotton and silk maker as well as the third cellulosic fiber manufacturer.

In 2014, India manufactured1,28 million tons of man-made fiber while the country’s yarn production reached 48,900 tons in that period. The country’s fabric production reached 63,319 million meter squares in 2014. Ready-wear has a large share of 70% in total power of textiles and ready-wear industry. Ready-wear is being carried by 77.000 small scaled manufacturers.

805 of woolen products are manufactured in India’s north region: Kashmir, Ludhiana and Panipat. Delhi and Gurgaon are important hubs of ready-wear, meanwhile. In east, Bihar is an important location for jute production. Uttar Pradesh is a hub for woolen textiles, while Bengal is important in cotton, woolen and jute products. In west, Ahmedabad, Mumbai, Surat, Rajkot, INdore and Vadodara are famous with their cottons. Mumbai and Nagpur are important cities in terms of ready-wear. In south, there are many ready-wear and under-wear manufacturers active.

According to data from India’s Ministry of Agriculture, around 40 million bundles of cotton are produced annually as it is the main raw material of the industry. As the second largest cotton producer of the world, India also exports cotton yarn. In 2014-2015, total cotton planting was held on 12,25 million hectare field. In the period, India exported a USD1,8 billion of cotton. China was the largest purchaser with 40% which was followed by Bangladesh with 32%. Turkey imported a USD 30 million of cotton from India in this period. India’s cotton yarn exports totaled USD 3.9 billion in which Turkey had a share of USD37 million.

Jute is planted in Ganges River delta and is named as “Golden Yarn”, while it is a conventional textile raw material used in India. Jute textiles were used in 19th-20th centuries and remains as a crucial segment. According to data from the Ministry of Textiles, 4 millions of farm families are currently earn their keep from jute manufacturing. There are 89 jute facilities and 49,500 hand looms for jute weaving in total. The total capacity of jute factories are declared as slightly more than 2,64 million tons per year. In 2014-2015, India exported 106,000 tons of jute, while earned USD297.000. The US was ranked as the first destination with a share of 23%.

India is the world’s second largest silk producer. According to Central Silk Board, 26.480 tons of silk were manufactured in India during 2013-2014, out of which 74% was pure silk and 26% was wild silk. On the other hand, India’s silk consumption surpasses production at around 29.740 tons. The country meets silk demand via imports from China.

Ready-wear segment draws a multipartite outlook given low fund and other reasons. According to WTO data, India ranked as the fourth in 2014’s ready-wear exports following China, Bangladesh and Vietnam. The country’s main export destinations were the US, EU and UAE. Housing more than 75.000 facilities, majority of ready-wear manufacturers are working for the domestic market. The industry counts for 21% of total employment while employees total around 35 million. The figured reaches 60 million adding employees from by-industries.

Small Scaled Facilities Dominate Industry

Indian textile industry has outstanding cotton, jute, silk, woolen, hand arts, technical textile and ready-wear segments while it generally consists of small scaled, non-integrated yarn production, weaving and pattern, finishing and ready-wear structures. Production facilities usually have low technologies and they are labor intense. Comparatively large scale factories count for only 3% in overall while most of them are state-owned.

Spinning mills rapidly expanded in line with liberalization of the market in 1980s. Cotton forms the main segment in yarn manufacturing. It counts for 61% of total yarn production at approximately 67,360 tons.

The report reveals that organized facilities in weaving and knitting industries count for 5% of total production. This segment houses 3.9 million handlooms as well as 1.8 million electrical weaving looms.

There are quite many textile finishing facilities and they are small scaled. Across India, there are 2300 manufacturers out of which 2100 are formed by independent units. 200 of them are operating as integrated with yarn, weaving and knitting units.

Indian government plans textile and ready-wear industry to export nearly USD65 billion until the end of the 12th Five Year Development Plan (2012-2017). A budget of USD4,25 billion was allocated in order to support textile industry as a part of the plan. The industry receives support via private exports subsidies such as export loans, while exclusive economic zones are operating free of tax. There are more than 50 EEZs at different locations of India.

According to report, direct foreign investments are allowed with automatic routine of up to 100% in India. In 2015-2016 budget, USD40 million was allocated for integrated textile parks (ITP). The Ministry of Textiles approved an offer for 24 brand new textile parks to be established in February 2016. An investment of USD4.6 billion is said to be required for those constructions. Also, Indian government implemented a program for modernization and renewal of technologies of related plants. The country is expected to boosts its exports via agreements with the European Union and FTA with ASEAN nations.